Welcome to Morrow.

Before saying much more, we’ll get two questions out of the way:

(1) Why am I writing this?

(2) Why are you receiving?

The answer - I am starting a company called Morrow and, as a recipient, you have played some contributing role — maybe big, maybe small, but nonetheless important and very much appreciated. So, first and foremost, I’d like to extend a meaningful thank you for that. I view this letter, which I plan to write monthly, both as a way to acknowledge that support and bring you aboard this great journey. If at any point you wish to disembark, there’s a handy “Unsubscribe” button which will serve as your parachute eject button setting you free with no hard feelings attached. Exits to the back and sides. Seat can be used as a flotation device. You know the drill.

Before jumping in, a quick word about how I’ll write these going forwards - these letters will contain three sections:

(1) Founder perspectives

(2) Company updates

(3) Areas of focus

Having laid out that clear, organized structure, this first letter will take its own form as I begin with a background on what Morrow is and why I’ve set out to build it, followed by a status post and roadmap outline for the company.

What’s Morrow and why?

One of the bigger developing crises in our country that hasn’t exactly filtered into the mainstream socioeconomic conversation are the deteriorating retirement conditions in the US upheld by a dated and fractured support system. While there’s growing attention, most Americans still don’t fully appreciate the gravity of the situation. To demonstrate, here are a few facts that might surprise you…

45% of Baby Boomers have $0 of retirement savings1

63% of non-retirees say their retirement plans are not on track or they aren’t sure2

70% of American workers agree they don’t have financial skills to manage their money in retirement3

Beneath those numbers, an equally troubling equation is lurking. It looks like this:

Seniors as % of total population (📈) + Avg lifespan (📈) + Retirement savings deficit (📈) + Strength of traditional retirement infrastructure (📉)There’s plenty to be said and read on each variable, but to paint each of them quickly with a brush of color:

(1) Seniors as % of total population —

There are ~52M Americans aged 65+ today. By 2034, in 13 years, that number will grow ~50% to 77M.4

(2) Average lifespan —

In 1980, the average American life expectancy was 73.7. In 2017, it grew to 79.7. It’s projected to rise to 85.6 by 2060.5

(3) Retirement savings deficit —

Just 1 in 3 American workers will have saved enough to comfortably retire by the age of 676

(4) Strength of traditional retirement infrastructure (e.g. pensions, social security)

The number of defined benefit pension plans declined 73% from 1986 to 20167

Over half of Americans (57%) aren’t confident in Social Security8

Morrow - Updates & Focus Areas

Onto Morrow…

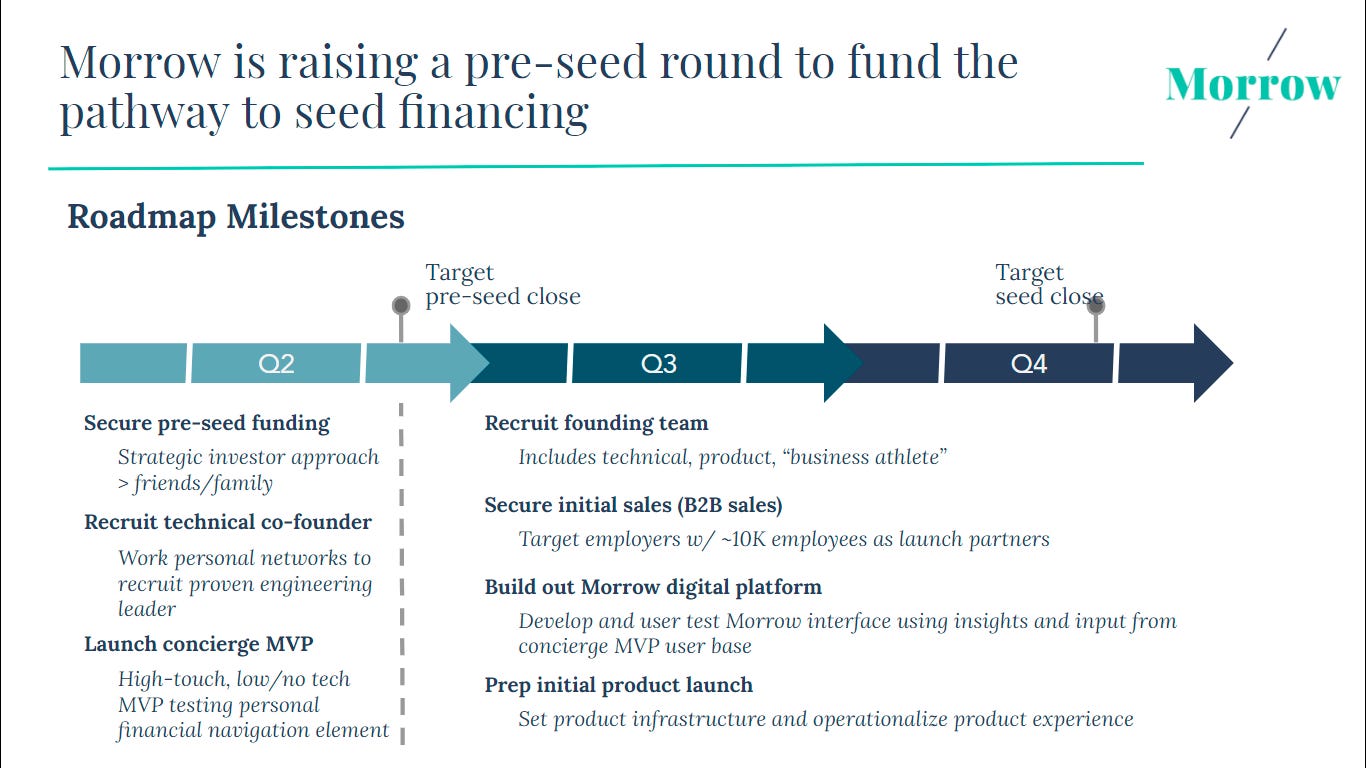

As a mechanism for structure and clarity, I’ve simplified the coming two months into three objectives, which, if executed, will move Morrow into its next chapter. The three things are:

(1) Raise a pre-seed financing round

(2) Launch a concierge MVP (minimum viable product)

(3) Recruit a technical co-founder

(1) Raise a pre-seed (angel) financing round

Funding conversations kicked off this week. The strategy behind it has been one of securing strategic angel investors (ex. fintech founders/executives; deep-knowledge industry players; sales lead gen facilitators) and/or pre-seed-focused funds to the cap table. My last interest is to pursue a venture which I think is the belle of the ball and everyone in the market thinks is a frog. With that as a north star, this raise offers the chance to both add strategic value and gain market validation, in addition to capitalizing the company for its next stage.

Ways to help —

Any introductions to strong angel investors or pre-seed funds that come to mind are warmly welcomed and appreciated. Investors with a fintech focus is a plus. Also, I can share the deck with anyone receiving this note - just ping me at sammy@usemorrow.com.

(2) Launch a concierge MVP

First, an explanation - a concierge MVP is a high-touch, low/no tech minimum viable product intended to validate product value. In our case, it will also serve as an excellent channel for user insights. The details of the concierge MVP (which I’m calling our Beta Program) are spelled out here.

Ways to help — We’ve recruited a core team of retirement counselors and have collected our first participant sign ups for the Beta, but are still looking for more takers.

For all of you still reading - if you have people in your life that are going through a challenging retirement transition period, we’d love to help them. Please have them reach out to me at sammy@usemorrow.com or you can direct them to the website (usemorrow.com).

(3) Recruit a technical co-founder

Doing #1 and #2 on this list will make #3 much easier, but cannot wait as a dependency. I’ve defined several composite profiles for co-founder candidates that would be attractive. The strategy has been to work my personal network within the fintech world and access proven technologists at credentialed fintech companies - these are the individuals who have the best visibility and reach to top talent.

Over the past two weeks, I’ve run 10+ interviews with product or engineering leaders from the likes of Credit Karma, United Income, and Carta. Three of those interviews offered to assist Morrow in an advisor capacity unsolicited, which was received as a nice vote of confidence. Sourcing the right co-founder is a mechanical process - largely a numbers game - so I plan to keep high-quality intro calls running at that pace. I build network and grow insights in the process. Picking the right co-founder is a personal process - so I plan to give that the diligence and patience it’s due.

Overall, my approach is one of high-effort and curation, producing high quality leads with some degree of relationship connection.

Ways to help —

If you know of any sharp, technical entrepreneurs looking for their next chapter, please steer them my way. Also feel free to copy and paste this blurb as context:

Morrow is a retirement navigation and financial support platform built for modern retirement. Our aim is to help everyday Americans navigate a wave of scary, unfamiliar decisions separating them from a secure retirement. We're currently raising a pre-seed round and are interested in speaking with technical co-founders with a fintech background. Reach out to Sammy at sammy@usemorrow.com for more information.

— Sammy

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.” - W. Churchill

https://www.myirionline.org/docs/default-source/default-document-library/iri_babyboomers_whitepaper_2019_final.pdf?sfvrsn=0

https://www.federalreserve.gov/publications/files/2019-report-economic-well-being-us-households-202005.pdf

https://www.nirsonline.org/wp-content/uploads/2021/02/FINAL-Retirement-Insecurity-2021-.pdf

https://www.census.gov/library/stories/2018/03/graying-america.html

https://www.census.gov/content/dam/Census/library/publications/2020/demo/p25-1145.pdf

https://feinew.org/resources/Documents/3-19-19%20Chapter%20Meeting%20-%20Retirement%20(Aon).pdf

Employee Benefits Security Administration

https://www.aarp.org/retirement/social-security/info-2020/aarp-poll-finds-near-universal-support.html