Morrow - April Letter

New look...same Morrow.

Last month I introduced Morrow and painted an outer space view of the problem statement at hand. This month my perspectives shift towards product — namely market perceptions and the influencing forces that shape product vision.

Founder perspectives —

1) The “Senior Luddite” fallacy

Someone just walked up to you and asked you to describe a “senior citizen.” After taking a second to collect yourself from this bizarre encounter, what do you say? Do you describe (A) your 90 year-old WWII veteran grandfather who is a legend, but has been impacted by the laws of age and now lives a peaceful, yet limited existence in a nursing home? Or do you describe (B) your very active, 65 year-old mom that just spent the day entertaining the grandkids at the park with more energy than you had playing high school basketball? There isn’t a right answer, but if it’s the former, you aren’t the only one.

The technology sector and broader market have also tended to mistakenly apply a set of tech-related presumptions to the “senior” user using Profile A above as it relates to tech interest and aptitude. (Note: Morrow prefers to refer to “seniors” as “older adults.”) Aiding this problem is a loose and imperfect definition of “senior citizen,” which generally is accepted as anyone over the age of 65 and has no age cap.

It’s worth pausing here because it means that your legendary 90 year-old grandfather has been designated as a senior for 25 years. That’s a long time… One implication is this: when the market goes to build products for seniors, it’s attempting to build products for a moving target somewhere between the age of 65 and however old you happen to live. Not exactly the recipe for deeply understanding your user. It also makes it easier to understand the failure among fintechs to adequately build products for this demographic.

The truth is that adults in this age bracket are not a gang of cave-dwelling Luddites. There has been meaningful movement in the tech adoption rate among older Americans, particularly triggered by the impacts of the pandemic. That trend is sure to continue accelerating. AARP just released a terrific report (“2021 Tech Trends and the 50-plus”) that presents compelling numbers behind these shifts among aging Americans. It’s worth a quick flip.

2) The “Knight in shining technology” fallacy

There is a second misconception among financial technologists that I think breeds opportunity in the market and for Morrow. It’s the desire to believe that, since financial activities are quantitative and mechanical in nature, the right financial product — if built without fault or flaw — will allow financial matters to be fully self-servicing.

That’s true until we are reminded that humans are the ones making the decisions that result in the financial activities. These are the same emotional, fearful, and sometimes irrational humans that are tasked with navigating a life of risk and uncertainty. While plenty of financial activities are mindlessly transactional (e.g. paying your grocery bill), many are not (e.g. finding the most tax-favorable account for your retirement savings).

When it comes to unfamiliar decisions of consequence, trust is king. In finance. In healthcare. In everything. Trust breeds emotional conviction to step into a future with confidence and security.

The Financial Health Network, an active organization in promoting financial wellness accessibility, makes this point nicely. This spring they put out an outstanding report highlighting several key product design considerations when designing digital advisory tools for middle-income older adults. Of all findings, their top recommendation was “Provide social and emotional support.”

“Integrating human touch points as opposed to all-digital support at certain points can also provide emotional support as LMI older adults navigate unpredictable challenges in the years before retirement.”- Financial Health Network (Designing Digital Financial Advisory Tools for Low-to-Moderate Income Older Adults)

The point to make is that the problems Morrow is aiming to solve are as much human-rooted problems as they are financial. When faced with large decisions, people pay for trust, and people trust other people above all else. Technology can and will create efficiencies within the machine, but starting with a product that ignores the human element for the sake of scale or anything else is a false start.

3) Converging on Morrow’s Product

The product opportunity for Morrow comes into view when separate opportunities in technology design and personalized human navigation are bridged for this target user. [For Morrow, we describe our target user as an everyday, 55-65 aged worker within 5 years of retirement.] The reason I bore you with the perspectives above is because they feed directly into Morrow’s product vision. This vision integrates (A) trustworthy and memorable experience delivered through personalized retirement navigation + (B) an engaging technology platform that continues to empower users in their retirement journey made only possible through surgical user design. The two are inseparable — one feeds the other.

Consider the teacher and the textbook. The coach and the scouting report. The therapist and the exercises. Motivation is only helpful if there are supporting tools/infrastructure to execute on it. A tool is only helpful if there’s motivation to use it. The complementary nature between the two are integral to the product experience and efficacy as they are to user the acquisition and retention.

Company updates —

1) Beta Program is live!

We’re off! The Beta Program went live this month, which means Morrow is officially (actually unofficially) released in the wild. We’ve started providing our retirement navigation services to a cohort of participants, a launch that’s been both exciting and rewarding as we witness the early impact Morrow is having on people’s retirement outlook. Early feedback from participants has been strong and we look to continue building on it. Stay tuned for deeper detail coming in the next letter…

A noteworthy shoutout to Ron Conarroe, who is leading our retirement counselor team after recently retiring himself as a retirement professional at Morgan Stanley for over 37 years. He represents the Morrow standard!

2) Fundraising is underway and tracking well

Fundraising efforts on the pre-seed round are progressing nicely with just over half the round filled and maintaining course to close this month. Commitments consists of a top-line group of angel investors representing each of the three angel categories targeted. Those categories are:

Fintech founders/executive value - experience building companies; well-networked to talent/investors in the ecosystem; learnings from fintech-related challenges (e.g. GTM)

Examples: Chime, Stripe, Plaid, Credit Karma, Wealthfront

Domain value - great depth of retirement industry knowledge; well-networked with industry leaders (companies & people)

Examples: AARP, Fidelity, Personal Capital, Empower

Sales value - corporate benefits leaders, "door opener" for B2B sales; experience / well-networked selling into HR; sales strategy & lead gen

Examples: HR leaders at Fortune 500s, AON, Watson Towers Willis, BetterUp, ZocDoc

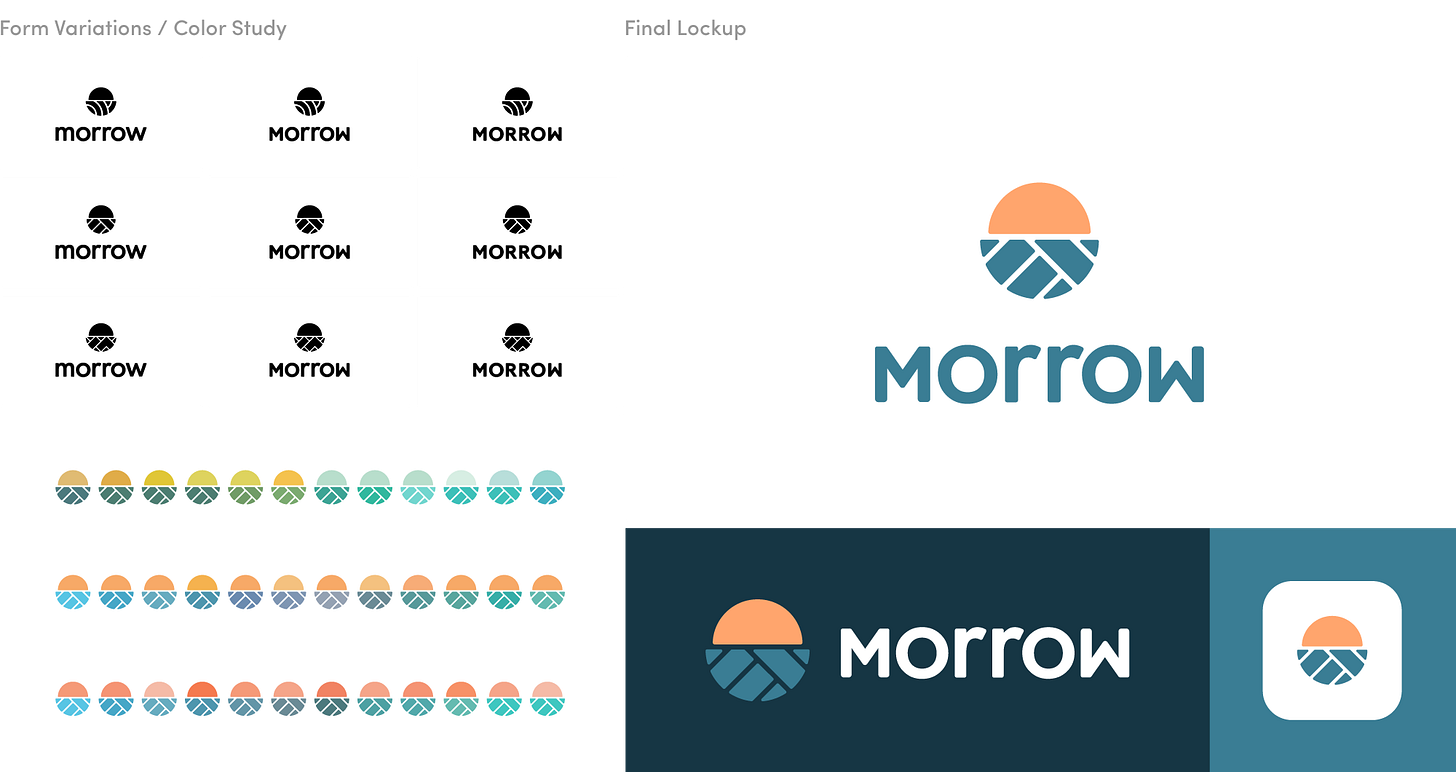

3) New Morrow look

Surprise! Morrow had some cosmetic work done and is looking better than ever. One of my favorite things about the Morrow name is the balance and strength it carries in structure, complimented by a comforting tone. The new design seeks to pay tribute in color, type, and mark selection to those themes.

Another great shoutout here to Amy Devereux who led the inspirational charge and has done a superb job in design. Highly recommend for those seeking design work!

Areas of focus —

In rank order, the priorities for Morrow for the month of May remain:

Closing of pre-seed round

Growing and refining the Beta Program

Sourcing and interviewing technical co-founders

These are the ways you can help —

We’ve started to speak with groups such as police officers, firefighters, and teachers as possible participants for our Beta Program. If you know of communities that might benefit from a period of retirement counseling at no charge, we’d like to see if we can be of assistance. Or individuals that could benefit from this service. Our ideal profile is someone around 60 years old, approaching retirement in the next 5 years, and has unanswered retirement related questions. You can direct them to sign up on the website (usemorrow.com) or you’re welcome to put them directly in touch with me at sammy@usemorrow.com. Details on the Beta Program are here.

“Sometimes new markets look too small or appear not to be critical to our customer base - until they are.” - Jamie Dimon, Letter to Shareholders - 2021

Thanks for reading.

— Sammy

P.S. if you wish to be on the auto-distribution list, hit the Subscribe button or enter your email.